All Categories

Featured

Table of Contents

A PUAR allows you to "overfund" your insurance coverage right up to line of it ending up being a Changed Endowment Contract (MEC). When you make use of a PUAR, you quickly boost your cash money value (and your survivor benefit), thereby enhancing the power of your "financial institution". Better, the more cash value you have, the greater your interest and returns settlements from your insurer will be.

With the rise of TikTok as an information-sharing system, economic recommendations and strategies have actually discovered a novel way of dispersing. One such method that has been making the rounds is the boundless banking idea, or IBC for brief, amassing recommendations from stars like rapper Waka Flocka Fire. While the approach is presently popular, its roots map back to the 1980s when economic expert Nelson Nash presented it to the world.

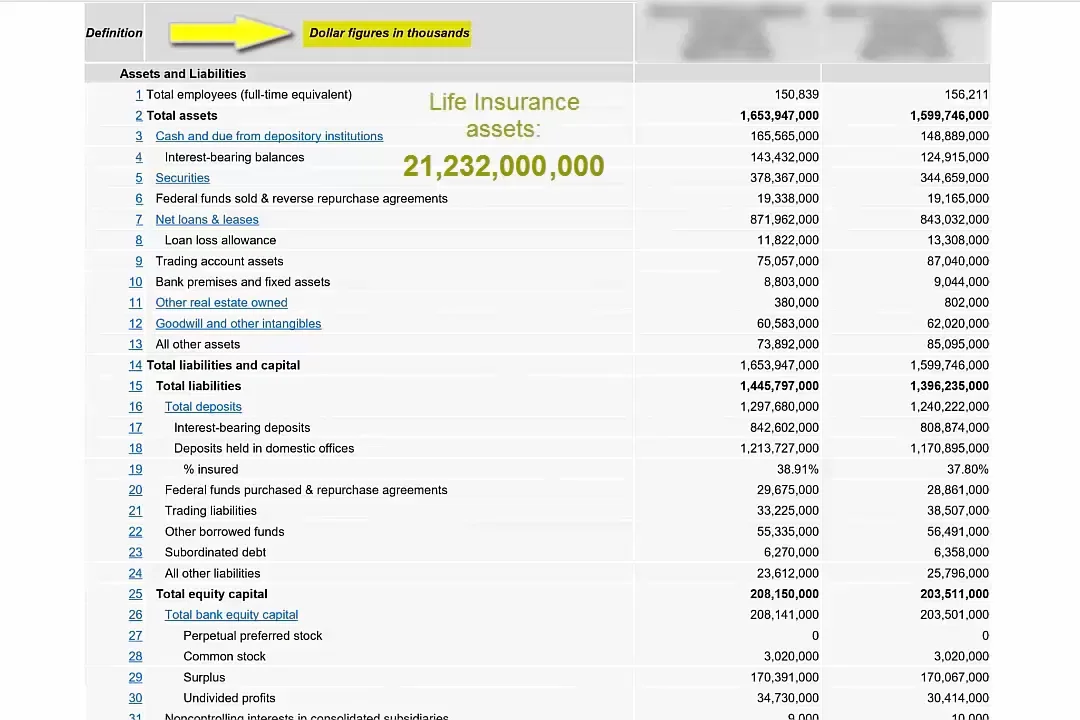

Infinite Banking In Life Insurance

Within these policies, the cash money value expands based upon a price established by the insurance firm (Infinite Banking cash flow). Once a significant money worth accumulates, insurance policy holders can get a cash money worth financing. These loans vary from standard ones, with life insurance policy acting as collateral, meaning one can shed their insurance coverage if loaning excessively without appropriate money value to support the insurance policy costs

And while the attraction of these plans appears, there are inherent limitations and dangers, requiring thorough money worth surveillance. The method's authenticity isn't black and white. For high-net-worth people or entrepreneur, especially those utilizing methods like company-owned life insurance coverage (COLI), the advantages of tax breaks and compound growth can be appealing.

The attraction of limitless banking does not negate its difficulties: Expense: The fundamental demand, an irreversible life insurance plan, is costlier than its term equivalents. Eligibility: Not everybody receives whole life insurance coverage because of strenuous underwriting procedures that can omit those with specific health and wellness or way of life problems. Complexity and threat: The detailed nature of IBC, paired with its dangers, might deter many, specifically when simpler and much less high-risk choices are offered.

Infinite Banking Wealth Strategy

Assigning around 10% of your regular monthly revenue to the plan is simply not viable for the majority of individuals. Component of what you check out below is just a reiteration of what has actually currently been stated above.

So before you obtain into a circumstance you're not prepared for, know the complying with initially: Although the principle is commonly marketed thus, you're not actually taking a funding from on your own. If that held true, you wouldn't need to settle it. Rather, you're borrowing from the insurer and have to settle it with rate of interest.

To successfully implement Infinite Banking, it’s essential to consult an experienced broker (does infinite banking work for high-income earners).

The first step is choosing a properly structured whole life insurance policy that offers strong dividend potential.

Unlike traditional loans, Infinite Banking eliminates the need for credit checks. Schedule a strategy session with a broker to secure a whole life policy tailored to your needs.

Some social media posts recommend using cash money worth from entire life insurance policy to pay for credit scores card financial debt. The concept is that when you repay the funding with interest, the quantity will certainly be sent out back to your financial investments. Unfortunately, that's not how it works. When you repay the funding, a part of that interest mosts likely to the insurance policy business.

For the first several years, you'll be repaying the payment. This makes it incredibly hard for your policy to gather value throughout this time. Whole life insurance policy expenses 5 to 15 times extra than term insurance policy. Many people just can't manage it. Unless you can afford to pay a couple of to a number of hundred bucks for the next years or even more, IBC will not work for you.

Who can help me set up Bank On Yourself?

Not everyone needs to rely exclusively on themselves for monetary protection. If you require life insurance policy, right here are some useful tips to consider: Take into consideration term life insurance coverage. These plans give coverage during years with significant monetary obligations, like home loans, pupil financings, or when caring for young kids. Make certain to look around for the best rate.

Think of never ever having to stress concerning financial institution finances or high interest prices again. That's the power of limitless banking life insurance coverage.

There's no collection financing term, and you have the liberty to choose on the repayment timetable, which can be as leisurely as paying back the financing at the time of fatality. Infinite Banking wealth strategy. This versatility includes the maintenance of the car loans, where you can choose for interest-only settlements, keeping the finance balance level and manageable

Holding cash in an IUL fixed account being credited interest can commonly be far better than holding the cash on deposit at a bank.: You have actually always imagined opening your own bakery. You can obtain from your IUL policy to cover the initial expenses of renting out a space, purchasing tools, and hiring team.

Can anyone benefit from Financial Independence Through Infinite Banking?

Individual financings can be acquired from standard banks and credit score unions. Borrowing money on a credit rating card is usually really costly with yearly portion rates of rate of interest (APR) commonly getting to 20% to 30% or more a year.

Table of Contents

Latest Posts

Infinite Banking Testimonials

Infinite Banking 101

Whole Life Concept Model

More

Latest Posts

Infinite Banking Testimonials

Infinite Banking 101

Whole Life Concept Model